The Hidden Dangers of Fee Caps

A Capped Agent Becomes a Complacent Agent

Cost vs Results

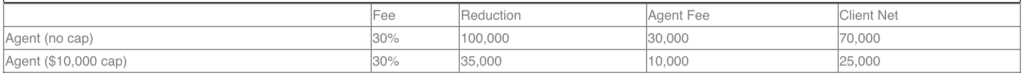

As a prudent multifamily owner, managing costs is very important. If you hire a roofer, you will want to know and approve the contract cost upfront. Property tax agents sometimes present a tempting offer to cap fees, but there is a hidden dark side when you play that game. You may worry about how much a tax agent without a fee cap will cost, and that is a valid concern. From experience, I have seen that capping an agent far outweighs the benefit to the client. I would like to pull back the curtain for just a moment and help you glimpse the danger lurking in such a deal.

Compensated based on success

Property tax agents are typically compensated based on their success. This means that you always come out ahead if you are paying them a fee. When there is no cap, excellent agents do their best to examine every angle and opportunity to reduce your property taxes. They know that the better they represent you, the higher your savings and their fee.

On the flip side, you may see agents with a contingency fee plus a cap. This means that no matter how good they do, they will only receive the maximum cap amount. Agents under such a deal know exactly the amount of reduction they need to hit the cap and the temptation is to do just enough to hit the cap. Anything above that they are doing for free. The true danger to you, as a multifamily owner, is that you don’t get the lowest value and tax bill. You only get it low enough for your agent to max out their cap. Thousands of dollars of additional tax savings may be readily on the table, but since there is no upside to a capped agent, they aren’t asking for it. You ultimately lose tremendous tax savings, which usually far outweighs the cost of removing the cap.

You become a volume client

Another danger with using caps with your property tax agent is that you become a volume client. There is hardly any incentive for them to visit and know your property. They can likely secure the reduction necessary to hit the cap with minimal effort. Your property is just one of the thousands that churned out with little thought about the property itself. Getting an update on your property will likely be difficult if you can get one at all. Volume clients usually hear from their agents a few times a year. Does the following communication sound familiar?

1. When they need something signed by you.

2. When they need information, usually last minute.

3. When you get their invoice.

Be Unique

Your company and properties are unique and important to you. Hire an agent who treats them that way. The agents who give excellent service don’t have fee caps, and you wouldn’t want them to. I want you to have confidence you are getting the best representation possible. We have put together an agent checklist that helps you evaluate your current agent. It is valued at $1,000, but I want to gift it to you and my expense today so you can make sure you are prepared for the 2022 Texas appeal season. I hope you will take advantage of reviewing your agent and securing your maximum tax savings next year.