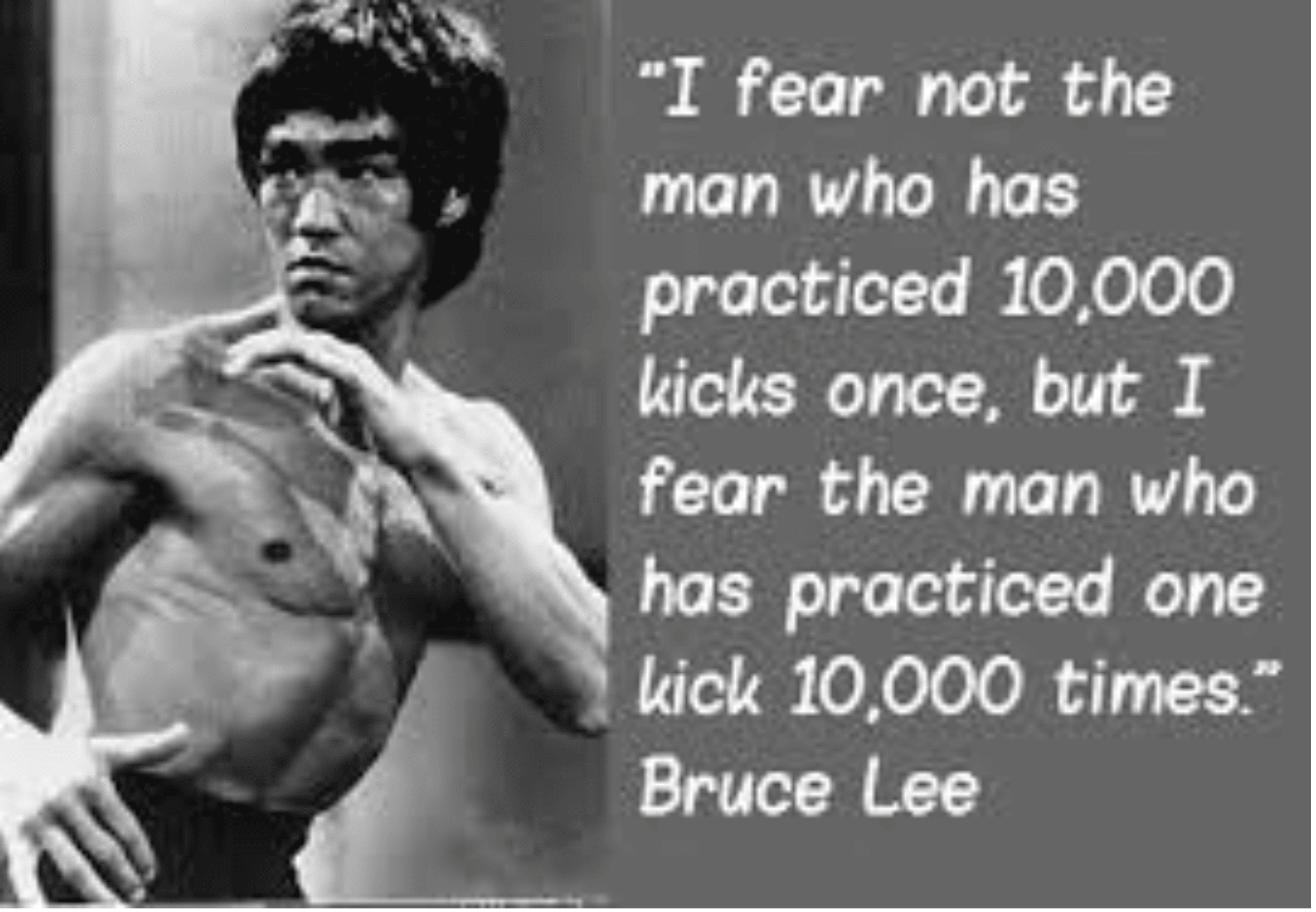

The greatest in the world in any field, be it surgeons, athletes, musicians, etc, are those who are dedicated to their craft and repeatedly focus their efforts on excellence. Others may practice, but the greatest consistently perform, and then ask, “what was the result and how can it improve?” They then do it again. They do not stop when others stop. They do not give up when it is difficult or seems impossible. They persevere, never letting obstacles stop them from their goal of excellence.

Our society values and rewards specialization. Just look at the salaries of specialized surgeons, athletes, or musicians. If I needed heart surgery, I would seek out the best heart surgeon, not my primary care physician. I know that my primary care physician, while a capable doctor, is not the best for what I need: heart surgery. A professional baseball team needing a pitcher, would not search out an outfielder to fill their need. While both players are skilled, their specific expertise does not translate to excellent performance.

Why should hiring a tax agent be any different? Most property tax firms are like primary care physicians. They are capable of general care and are helpful for common issues, but unfortunately, that does not mean excellence for any specific property types or issues. On the other hand, multifamily specialists, like heart surgeons, focus only on multifamily properties. They are dedicated to excellence, consistently perform, and then ask, “what was the result and how can it improve?” They then do it again. Right now, it is more important than ever that you have the best multifamily property tax expert on your team helping your company weather the economic storm of Covid-19. Hiring a multifamily specialist can save you time, reduce your property tax expenses, and be the game-changer you need right now.

Wayfinder Tax Relief, LLC is the #1 multifamily property tax specialist in the industry. They focus solely on multifamily properties and are at the cutting edge of the industry change. They are involved in many local apartment associations and are members of the Texas Apartment Association and the National Apartment Association.