Why we are passionate about knowing your properties

Appeals in a Big Firm

Everyone has reasons for doing what they do, and I am no exception. I used to be a partner at a national firm with properties all over the country. I took pride in my work and in our team, and I loved helping clients reduce their property tax burdens. After many years and thousands of hearings, I was given the assignment to handle our firm’s protests in Louisville, Kentucky. I eagerly prepared to go and attend the hearings, but as busy as we were, I was only able to review the properties from CoStar and the internet. I found comparable property sales and put together my evidence, sure that my workup was bulletproof.

Shocking Reality Check

When I arrived at the hearing, I began to present my case with full confidence in my work product. The board respectfully listened, and then when I finished they began to ask me some tough questions. They asked me about the neighborhoods and areas of town, and which adjustments were made and why. They asked about the condition of the subject and the comparables. I did not know the answers. Finally, I was asked a life-changing question: had I ever seen or visited any of the properties in person?

Under oath, I had to admit that I had not seen them. Their response shook me: “No one who knows anything about this part of town and these properties would ever consider them comparable.” That was it–the nail in the coffin. I did not secure a single reduction for my client that day, but I did walk out of that hearing with a firm conviction that I would NEVER be in that situation again. I vowed that I would represent my clients as if I owned the properties myself. I would visit every property and I would do my best to visit every equity or sale comparable we would use. At the end of the day, no one in the hearing room would know more about the subject property and the comparables than I would.

Starting Over

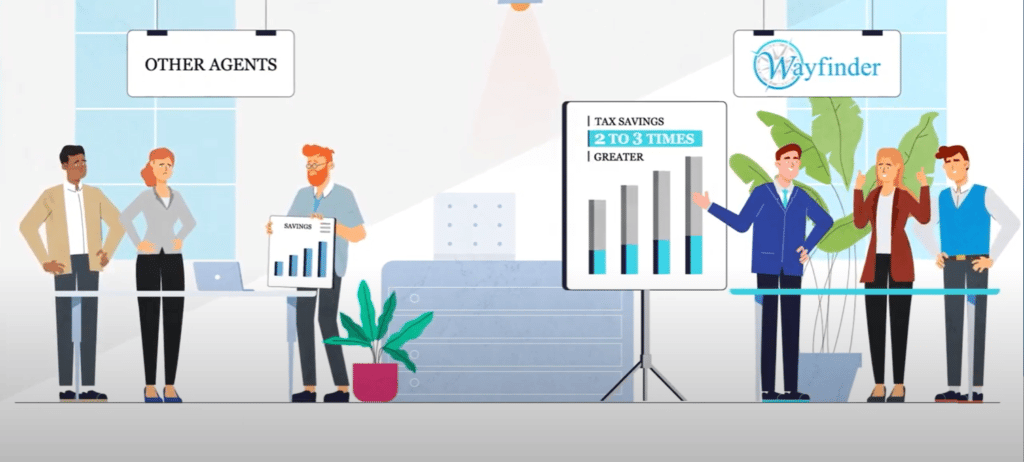

Upon seeing that I could not make that change in my national firm, I set out to create my own firm. I noticed that at national firms, agents are often overburdened and don’t have time to visit every property. The reason I founded Wayfinder is to be different from the busy national firms and to provide personalized expertise and representation. We are founded on the principles of integrity, accountability, and excellence. I have never forgotten the shame I felt in Louisville, Kentucky, and I never want to feel it again. When a client entrusts you with their appeal, agents should never take that responsibility lightly. They should do more than you can on your own because they are fully dedicated to representing properties in the appeal process.

Giving the Best to Our Clients

This monumental change in my perspective has caused us to spend countless hours visiting properties all over the markets where we represent our clients. The results have been profound. We have spent time learning the markets, asking questions, and becoming experts in the properties, knowing we are doing everything in our power to truly represent our clients.

See How Wayfinder Can Help

Recent Comments